500+ MCA Certified Expert

10,000+ Trusted Reviews

2500+Monthly Clients Onboarded

Serving Businesses Across India

Start your Nidhi Company effortlessly with Taza financial Consultancy Private Limited – your trusted partner for setting up a member-driven financial institution under the Nidhi Rules, 2014. We ensure full compliance with MCA guidelines and provide expert legal and procedural assistance at every stage.

A Nidhi Company is a unique type of Non-Banking Financial Company (NBFC) formed with the core objective of cultivating the habit of saving and mutual benefit among its members. The key feature of a Nidhi Company is that it deals only with its members, accepting deposits and lending funds exclusively within this group.

These companies are incorporated under Section 406 of the Companies Act, 2013, and are governed by the Nidhi Rules, 2014, under the supervision of the Ministry of Corporate Affairs (MCA).

Yes, a Nidhi Company is classified as an NBFC, but it is fundamentally different from traditional NBFCs in its scope, structure, and regulatory framework.

🔹 No RBI Registration Required

Nidhi Companies are exempt from registration with the Reserve Bank of India (RBI).

🔹 Limited RBI Oversight

Since Nidhi Companies operate only among members, the RBI does not regulate their day-to-day operations. However, it retains the authority to issue directives if required under the RBI Act, 1934.

🚫 Issuing preference shares, debentures, or other debt instruments

🚫 Conducting chit funds, hire purchase finance, leasing, or insurance business

🚫 Accepting deposits or lending money to non-members

Unlike other NBFCs that are under RBI’s purview, Nidhi Companies are regulated by the Ministry of Corporate Affairs (MCA). They must comply with the provisions of the Companies Act, 2013 and the Nidhi Rules, 2014.

✅ Must attain at least 200 members within one year of incorporation

✅ Must maintain a minimum Net Owned Fund (NOF) of ₹10 lakhs

✅ Should adhere to strict deposit and lending limits

✅ Required to file annual returns and financial statements with the Registrar of Companies (RoC)

While the RBI does not directly regulate Nidhi Companies, it plays a limited supervisory role to ensure that:

✔ The financial system remains stable

✔ Companies do not step beyond their permitted operational boundaries

✔ Systemic risks are monitored, especially in cases of non-compliance

A Nidhi Company is ideal for individuals or groups looking to create a trusted community-based financial ecosystem. It offers a legal, secure, and compliant method for borrowing and lending among members, under minimal RBI oversight and full MCA regulation.

Thinking of registering a Nidhi Company?

Registering a Nidhi Company is a smart choice for individuals and communities aiming to encourage savings and provide financial support within a trusted network. Here’s why forming a Nidhi Company can be highly beneficial:

Nidhi Company registration is easier and more affordable than setting up other financial entities like traditional NBFCs. It involves fewer regulatory hurdles and legal complexities, making it ideal for community-based financial operations.

As a company registered under the Companies Act, 2013, Nidhi Company offers limited liability to its members and directors. Their personal assets are not at risk in case the company faces losses or debts.

Starting a Nidhi Company requires a minimum paid-up capital of just ₹5 lakh, which is much lower than what’s needed for other NBFC models. This makes it financially accessible for small groups and local communities.

Only members can deposit or borrow money from the Nidhi Company, ensuring better security and flexible lending. Loans are commonly issued against gold, property, or fixed deposits, streamlining the process with minimal paperwork.

Nidhi Companies are built on the concept of mutual benefit. By accepting regular deposits from members, they encourage a habit of saving and financial planning—especially useful in rural or semi-urban areas.

A Nidhi Company continues to exist regardless of changes in membership or leadership. It has perpetual succession, meaning the company does not dissolve if a director or member dies, resigns, or becomes insolvent.

All financial dealings—deposits and loans—are strictly between members. This means no involvement of third parties, fostering greater trust, transparency, and internal control within the group.

Being registered with the Ministry of Corporate Affairs (MCA) gives the company legal status and credibility. While it does not require RBI approval, its official registration builds confidence among members and stakeholders.

Before you begin the process of registering a Nidhi Company, it’s essential to understand the key legal and structural requirements. These guidelines ensure your company is compliant with the Companies Act, 2013 and the Nidhi Rules, 2014.

A Nidhi Company must be registered as a Public Limited Company under the Companies Act, 2013. It should also comply with all provisions of the Nidhi Rules, 2014, which govern its operations.

Minimum 7 Members: At the time of incorporation, your company must have at least 7 members.

Minimum 3 Directors: A minimum of 3 directors is required, and all of them must also be members. This reinforces the mutual benefit structure of the company.

Initial Paid-up Capital: A minimum of ₹5 lakhs is required at the time of registration.

Capital to be Increased: Within 1 year of incorporation, the paid-up capital must be increased to ₹10 lakhs, as per Rule 5(1) of the Nidhi Rules, 2014.

Net Owned Fund (NOF): The company must maintain a minimum NOF of ₹20 lakhs within the first year.

Your company name must end with “Nidhi Limited”.

Example: Sampurna Nidhi Limited

The company must issue equity shares only, with each share having a face value of at least ₹10. This ensures affordability and broad member participation.

Only individuals are allowed to become members of a Nidhi Company. Companies, trusts, or other entities are not eligible, maintaining the focus on personal financial support and community benefit.

A valid registered office address in India is mandatory. This address will be used for all official correspondence, statutory notices, and government filings.

By meeting these requirements, your Nidhi Company will be fully compliant and ready to operate within the framework of mutual benefit and financial inclusion.

Need expert assistance? Taza financial Consultancy Private Limited offers complete end-to-end support for Nidhi Company registration—right from documentation to MCA compliance.

Before starting the registration process for a Nidhi Company in India, it’s important to gather all necessary documents in advance. Ensuring that these documents are valid, up-to-date, and properly attested will streamline the application and prevent delays.

These documents are essential to verify the identity and address of all individuals involved in the company:

PAN Card:

Self-attested copy of the PAN card for all proposed directors and members. This is mandatory for identity verification and tax purposes.

Identity Proof:

Self-attested copy of any one of the following:

Aadhaar Card

Voter ID

Driving License

Passport

Address Proof:

A recent bank statement or utility bill (electricity, gas, or telephone) in the individual’s name, not older than 2 months.

Passport-Size Photographs:

Recent color photographs of all directors and members for identification purposes.

Digital Signature Certificate (DSC):

Required for all proposed directors to sign documents electronically while filing with the Ministry of Corporate Affairs (MCA).

The company must have a physical office in India, and the following documents validate the registered office address:

Proof of Office Address:

Latest utility bill (electricity, telephone, or gas) not older than 2 months, in the name of the company or the property owner.

No Objection Certificate (NOC):

If the premises are rented or leased, the landlord must provide an NOC allowing the use of the address for company registration.

Rent Agreement or Lease Deed:

A copy of the valid rent agreement or lease deed as evidence of occupancy.

Declaration by Directors:

A declaration that each director is eligible and not disqualified under Section 164 of the Companies Act, 2013.

Consent to Act as Director (Form DIR-2):

Each proposed director must submit a signed DIR-2 form confirming their consent to hold the position.

Tip:

It’s advisable to consult with a professional or legal advisor to ensure all documents are correctly prepared and submitted, as any discrepancy could delay the approval of your Nidhi company registration.

Registering a Nidhi Company in India involves a structured process governed by the Ministry of Corporate Affairs (MCA). The procedure is primarily completed online through the MCA portal and must follow the Companies Act, 2013 and Nidhi Rules, 2014.

Before anything else, you need to obtain essential digital credentials for your company’s directors.

Digital Signature Certificate (DSC): All proposed directors must get a Class 3 DSC to electronically sign and submit documents on the MCA portal.

Director Identification Number (DIN): Each director needs a unique DIN, which can be applied for during the incorporation process itself using the SPICe+ form.

Choosing a suitable company name is a key step.

File SPICe+ Part A through the MCA portal to propose and reserve the company name.

You can suggest up to two names. Ensure that the name ends with “Nidhi Limited” and is unique, non-offensive, and non-identical to existing names or trademarks.

These documents define the company’s purpose and internal rules.

Memorandum of Association (MoA): States the main objectives of your Nidhi company, which should include accepting deposits and providing loans only to its members.

Articles of Association (AoA): Outlines internal governance such as responsibilities of directors, rights of members, meeting protocols, and voting procedures.

Both documents must align with the Nidhi Rules, 2014.

Once your company name is approved and foundational documents are ready, proceed to file SPICe+ Part B, which is the main form for incorporation.

This integrated application includes:

Company incorporation

DIN allotment

PAN & TAN registration

EPFO (Employees’ Provident Fund) registration

ESIC (Employees’ State Insurance) registration

GST registration (if applicable)

Also attach:

e-MoA (INC-33)

e-AoA (INC-34)

All supporting documents like address proof, ID proof, declarations, etc.

This simplified process ensures you complete all statutory registrations in one go.

Once all documents are verified and approved:

The Registrar of Companies (RoC) will issue the Certificate of Incorporation (COI).

The COI confirms the legal formation of your Nidhi company and includes the Corporate Identification Number (CIN).

Only individuals can be members.

The word “Nidhi Limited” must appear in the company name.

Must meet capital and compliance requirements as per the Nidhi Rules, 2014.

Net Owned Funds (NOF) of ₹20 lakhs and minimum of 200 members must be achieved within one year of incorporation.

The total cost of registering a Nidhi Company in India varies depending on several factors, including government fees, professional services, and state-wise stamp duty. Here’s a breakdown to help you plan your budget more effectively.

These are the official charges paid to the Ministry of Corporate Affairs (MCA) for company registration filings. The cost is based on your company’s authorized capital.

✅ For a minimum authorized capital of ₹5 Lakhs:

MCA Fees Range: ₹4,000 – ₹6,000

These are fixed government fees and are non-negotiable.

Stamp Duty is imposed by the respective state government on key legal documents like the Memorandum of Association (MoA) and Articles of Association (AoA). This fee varies widely from state to state.

| State | Estimated Stamp Duty (₹) |

|---|---|

| Maharashtra | 10,000 – 15,000 |

| Karnataka | 7,000 – 10,000 |

| Delhi | 6,000 – 8,000 |

| Tamil Nadu | 5,000 – 8,000 |

| Uttar Pradesh | 6,000 – 9,000 |

| Gujarat | 5,000 – 8,000 |

| Rajasthan | 4,000 – 7,000 |

| West Bengal | 4,000 – 7,000 |

| Andhra Pradesh | 4,000 – 7,000 |

| Telangana | 4,000 – 7,000 |

| Madhya Pradesh | 3,000 – 6,000 |

| Bihar, Punjab, Haryana | 3,000 – 6,000 |

| Kerala, Odisha | 3,000 – 6,000 |

| Assam, HP, UK, CG | 2,000 – 5,000 |

| Jharkhand, Goa, J&K | 2,000 – 5,000 |

| Union Territories | 2,000 – 5,000 |

📝 Note: These are approximate values. Actual stamp duty may vary. Always consult a professional based on your state and situation.

Other costs involved in Nidhi company incorporation include digital certificates, consultancy, and minor administrative expenses:

| Item | Estimated Cost (₹) |

|---|---|

| Digital Signature Certificate | ₹1,000 – ₹1,500 per director |

| Consultant/Professional Fees | ₹5,000 – ₹15,000 |

| Miscellaneous Charges | ₹500 – ₹1,000 |

Costs may fluctuate depending on:

✅ The complexity of the documentation

✅ The experience of your consultant

✅ Value-added services included (like post-incorporation compliance)

| Component | Approximate Range (₹) |

|---|---|

| MCA Filing Fees | ₹4,000 – ₹6,000 |

| Stamp Duty (State-wise) | ₹2,000 – ₹15,000 |

| Other/Professional Fees | ₹6,500 – ₹17,500 |

| Total | ₹12,500 – ₹38,500 |

To avoid hidden charges or delays, always choose a reliable consultant or service provider who offers a transparent package with full compliance support for Nidhi company registration.

Once your Nidhi Company registration is complete, the journey doesn’t end there. To remain legally compliant and build trust among members, your company must follow several rules and regulations as laid out in the Companies Act, 2013 and the Nidhi Rules, 2014.

Within 12 months from the date of incorporation, your Nidhi Company must fulfill the following:

Your company must have at least 200 shareholders within the first year.

As per Rule 3(1)(d), your company should maintain a minimum NOF of ₹20 lakh, calculated as:

Paid-up Equity Share Capital + Free Reserves – Accumulated Losses – Intangible Assets

Your company can accept deposits up to 20 times its Net Owned Funds. This keeps the lending activities in check.

You must hold 10% of your total deposits as unencumbered term deposits in a scheduled commercial bank or post office to ensure liquidity.

What it’s for: Confirms your company has met the basic requirements (members, NOF, deposits).

When to file: Within 90 days of the end of the first financial year.

Includes:

Member count

NOF details

Deposits status

What it’s for: Apply for an extension if you haven’t met the 200-member or ₹20 lakh NOF requirement.

When to file: Within 30 days of financial year-end.

Whom to file to: Regional Director, Ministry of Corporate Affairs.

What it’s for: A half-yearly return showing compliance status.

When to file:

For the period ending March 31 — file by April 30

For the period ending September 30 — file by October 30

Submission: Must be digitally signed by a director or CS.

What it’s for: Declare your company as an official Nidhi Company under the Nidhi (Amendment) Rules, 2022.

When to file: Within 120 days of incorporation once 200 members and ₹20 lakh NOF are achieved.

Just like any company under the Companies Act, 2013, Nidhi Companies must also file routine returns:

Details: Shareholders, directors, company structure

Due: Within 60 days of AGM

Details: Profit & Loss, Balance Sheet, Auditor Report

Due: Within 30 days of AGM

At least 4 board meetings every year

Gap between meetings: Not more than 120 days

Once every year, within 6 months of financial year-end

Complying with these Nidhi Company rules helps maintain your company’s legal status, builds transparency, and enables smooth operations. Missing any of these could result in penalties or even cancellation of Nidhi Company status.

Need help staying compliant?

👉 Trust Taza financial Consultancy Private Limited to manage your end-to-end Nidhi compliance needs!

Nidhi Companies operate under strict rules and restrictions to ensure they stay true to their core principle — promoting savings and mutual benefits among members. These guidelines are outlined in the Nidhi Rules, 2014 and must be followed for legal compliance and operational transparency.

Nidhi Companies are permitted to engage in specific financial activities exclusively with their members. Here’s what they’re allowed to do:

Accept Deposits

They can accept savings, fixed deposits, and recurring deposits from their registered members — encouraging a healthy savings habit.

Provide Secured Loans

Loans can be issued to members against collateral such as:

Gold or silver

Immovable property

Fixed deposit receipts within the company

Loan amounts and terms must adhere to Nidhi Rules.

Offer Locker Facilities

Locker services may be offered to members on a limited basis, depending on the size and turnover of the company.

To prevent misuse and maintain their mutual benefit nature, Nidhi Companies are not allowed to:

❌ Engage in Non-Permitted Financial Businesses

They cannot deal in:

Chit funds

Hire purchase financing

Leasing finance

Insurance

Securities trading (shares, debentures, mutual funds, etc.)

❌ Issue Non-Equity Instruments

Issuance of:

Preference shares

Debentures

Other debt instruments

is strictly prohibited.

❌ Open Current Accounts

Members can only maintain savings, RD, and FD accounts. Current accounts are not allowed.

❌ Acquire Other Companies

A Nidhi company cannot acquire or control any company by purchasing its shares or appointing its directors.

❌ Engage in Non-Lending/Non-Borrowing Activities

It must stick to core activities — borrowing and lending among members only.

❌ Use Member Assets as External Security

Collateral provided by members cannot be used for purposes outside the Nidhi company’s lending operations.

❌ Enter Into Partnerships for Financial Activities

Borrowing or lending activities must be conducted directly by the company, not through partnerships or agents.

❌ Advertise for Deposits

Public advertisement for deposit collection is prohibited. However, per Rule 7:

A simple notice board at the company’s registered office displaying terms and interest rates is allowed.

❌ Offer Commissions or Incentives

Commissions, bonuses, or incentives for securing deposits or disbursing loans are not allowed. This ensures ethical conduct and avoids aggressive marketing.

| Allowed | Not Allowed |

|---|---|

| Accept deposits from members | Accept public deposits or advertise for them |

| Provide loans against security | Engage in chit funds, leasing, insurance, or hire purchase |

| Offer limited locker facilities | Issue debentures, preference shares, or other debt instruments |

| Operate under Nidhi Rules, 2014 | Enter partnerships or acquire other companies |

| Focus on member-based financial services | Pay commissions or open current accounts |

The Nidhi (Amendment) Rules, 2022 introduced significant reforms to ensure stronger governance, transparency, and protection of member interests in Nidhi companies. These changes reflect the government’s intention to bring more accountability and discipline to this unique financial model.

Companies intending to operate as Nidhi companies (bearing the name “Nidhi Limited”) must now apply for declaration as a Nidhi company within 120 days of incorporation by filing Form NDH-4.

Earlier, this was applicable only to existing companies seeking Nidhi status. This new requirement ensures early scrutiny and compliance.

To qualify for declaration as a Nidhi Company, the following minimum requirements must be met:

At least 200 members within 120 days of incorporation.

Net Owned Funds (NOF) of ₹20 lakhs, increased from the previous ₹10 lakhs.

These raised benchmarks ensure that only financially stable companies are allowed to operate under the Nidhi model.

The minimum paid-up share capital at the time of incorporation has been raised to ₹5 lakhs, encouraging a stronger financial foundation right from the start.

Only individuals who are registered members of the Nidhi Company are now allowed to become Directors.

This aligns with the principle of mutual benefit, keeping control of the company within the member community.

Opening new branches is now subject to approval from the Regional Director and only permitted after filing Form NDH-4.

This regulatory oversight ensures that expansion is monitored and compliant with legal norms.

The limits on deposits a Nidhi company can accept from its members have been revised, now linked to the Net Owned Funds of the company.

This step aims to encourage prudent financial practices and limit over-leveraging.

The amended rules introduce tougher penalties for non-compliance, stressing the importance of:

Timely filings

Accurate disclosures

Regulatory accountability

These provisions aim to bring greater transparency and restore public trust in Nidhi companies.

These amendments are designed to:

Prevent misuse of the Nidhi framework

Encourage only financially sound and transparent businesses to operate

Safeguard the interests of members and depositors

By tightening the rules, the government aims to uphold the integrity of the Nidhi model while allowing genuine companies to grow in a regulated environment.

Once your Nidhi Company is successfully registered with the Ministry of Corporate Affairs (MCA), the government issues a Certificate of Incorporation (COI). This certificate is the official proof that your company is legally formed under the Companies Act, 2013 and complies with the Nidhi Rules, 2014.

The Certificate of Incorporation (COI) confirms that your company:

Is officially incorporated under Indian corporate law.

Has met the initial compliance requirements for operating as a Nidhi Company.

Can legally carry out its business activities focused on mutual benefits and member savings.

The COI includes essential information such as:

✅ Legal name of the company (ending with “Nidhi Limited”)

✅ Corporate Identification Number (CIN)

✅ Date of incorporation

✅ Registered office address

You’ll need your Nidhi Company Registration Certificate for several key activities:

📁 Opening a company bank account

🧾 Applying for PAN, TAN, and GST

📜 Signing legal contracts or MoUs

📊 Participating in audits and compliance reviews

🏢 Getting licenses and government approvals

🤝 Building trust with members, lenders, and regulatory authorities

Follow these simple steps to download your COI from the MCA portal:

Visit the official website: https://www.mca.gov.in

Log in using your Business User ID and password.

Go to ‘MCA Services’ > Select ‘Get Certified Copies’ or ‘View Public Documents’.

Enter your CIN or Company Name in the search bar.

Pay the applicable fee (if any).

Download the Certificate of Incorporation in PDF format.

Save and print a copy for your records.

Keep both digital and physical copies of your COI safe. It is required during compliance checks, audits, business dealings, and for availing various government services.

Your Nidhi Company Registration Certificate is your company’s legal foundation. It not only validates your business structure but also enables you to operate legally and build long-term credibility with stakeholders.

Your questions, answered clearly by Taza Financial Consultancy Private Limited.

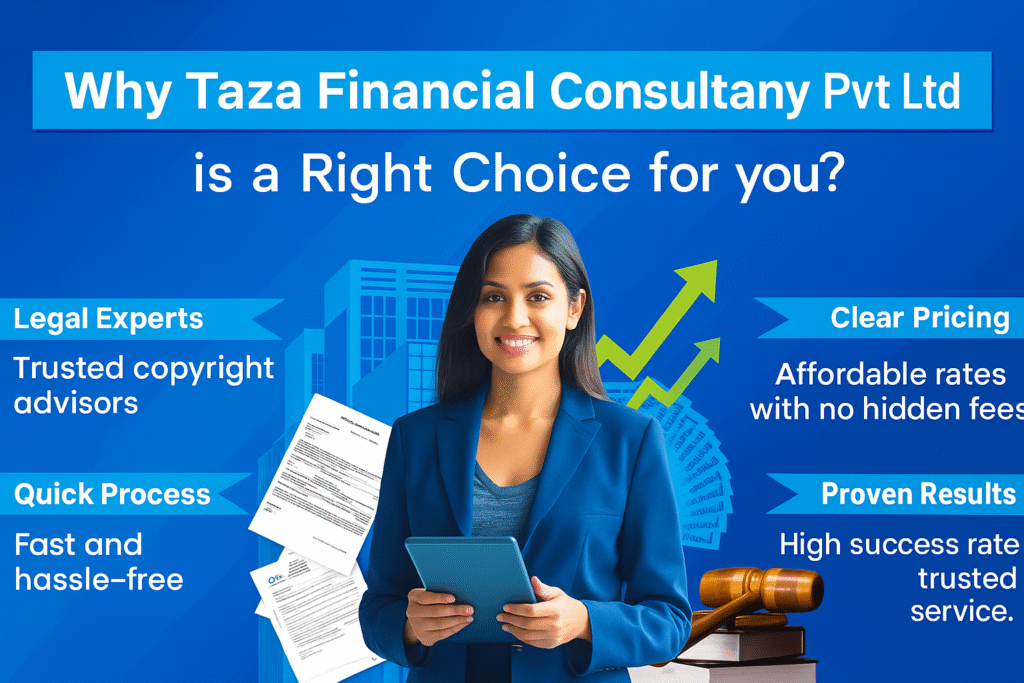

Starting a Nidhi Company involves multiple legal and procedural steps — but with Taza financial Consultancy Private Limited, the entire process becomes seamless, efficient, and stress-free.

Our experienced professionals ensure that your registration aligns perfectly with the Companies Act, 2013 and Nidhi Rules, 2014, minimizing errors and rejections.

From documentation to final submission, our 100% digital platform streamlines every step of the registration, saving your valuable time and effort.

We believe in honest pricing. With Taza financial Consultancy Private Limited, there are no hidden charges — you get a clear cost breakdown from day one.

No posts found!

Taza Financial Consultant is a part of Taza Financial Consultant Pvt. Ltd., registered under the Companies Act, 2013.

Disclaimer: This website is privately operated and has no affiliation with any government department or agency. We are not associated with, endorsed by, or connected to any government body in any capacity. The forms available on this website are not intended for official government registration; they are provided solely to collect details from our clients to better understand their requirements. By using this website, you acknowledge that Taza Financial Consultant is a private organization offering consultancy services based on client requests. Any fees collected here are strictly for these services. We reserve the right to outsource certain cases or matters if necessary. Our brand is currently undergoing a renaming process — stay tuned for further updates.

Copyright © 2025 All Rights Reserved.

Design & Developed By Catliza Web Technologies